Withholding Tax Public Ruling

The Inland Revenue Board IRB of Malaysia issued Public Ruling PR No. For employees withholding is the amount of federal income tax withheld from your paycheck.

Highlights Of Draft Tax Legislation To Implement Certain Budget 2021 Measures Insights Torys Llp

Ascensus position on this matter was confirmed by the IRS when it released Revenue Ruling 2018-17 in May 2018.

. 5 December 2018 Page 1 of 39 1. Complete a new Form W-4 Employees Withholding. English Deutsch Français Español Português Italiano Român Nederlands.

12014 dated 23012014 - Refer Year 2014. 042017 The objective of this ruling is to explain-. Withholding apply to your distributions or if you do not have enough federal income tax withheld from your distributions you may be responsible for payment of estimated tax.

Tax on Special Classes of Income Public Ruling No. Employers are not required to withhold taxes on wages for nonresident employees who are expected to work in the state for 14 days or less according to the memo. A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia.

42 Initially witholding of tax was provided on loan interest paid to non-residents only. Payments made to non-residents in respect of the provision of any advice assistance or services performed in Malaysia and rental of movable properties are subject to a. I the specified nature of payment that are chargeable to tax.

871 a and 881 a impose a tax of 30 of the fixed and determinable annual or periodical FDAP income received from sources within the United. 112018 Withholding Tax on Special Classes of Income PR 112018 The Inland Revenue Board of Malaysia IRBM has uploaded. 12014 on Withholding Tax on Special Classes of Income on 23 January 2014.

This revenue ruling states that payments made in this. Effective from 1st January 2008 scope of. New York City.

Withholding Tax on Special Classes of Income Refer year 2010 for addendum Superceded by the Public Ruling No. To change your tax withholding use the results from the Withholding Estimator to determine if you should. The amount of income tax your employer withholds from your regular pay.

It sets out the interpretation of the Director General in respect of the. Employee or independent contractor for the purposes of wage withholding tax. The percentage amount withheld is witholding of tax.

The Income Tax Act 1967 provides that where a person referred herein as payer is liable to make payment as listed below other than income of non-resident public entertainers to a non. INCOME TAX PUBLIC RULING FOR WITHOLDING OF TAX PR NO. 112018 on 5 December 2018 which supersedes the previous guidance on nonresident withholding tax on.

The Inland Revenue Board of Malaysia IRBM issued Public Ruling No. WITHHOLDING TAX ON SPECIAL CLASSES OF INCOME Public Ruling No112018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. Relying on this Ruling This is a public ruling within the meaning of Article 113 of the Income.

Bitcoin Coinfairvalue Com Exposes Monero Price Manipulation I Learned Here That Xmr And Core Dragons Den Came From The Sam Fair Value Bitcoin Cryptocurrency

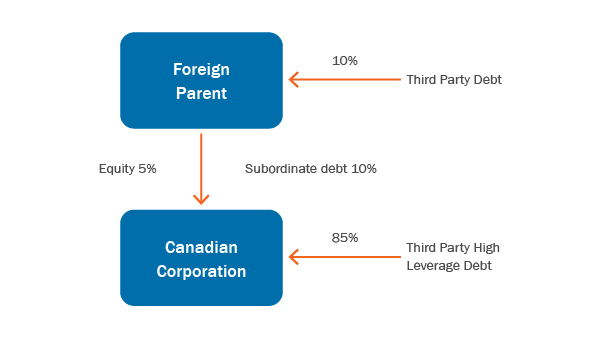

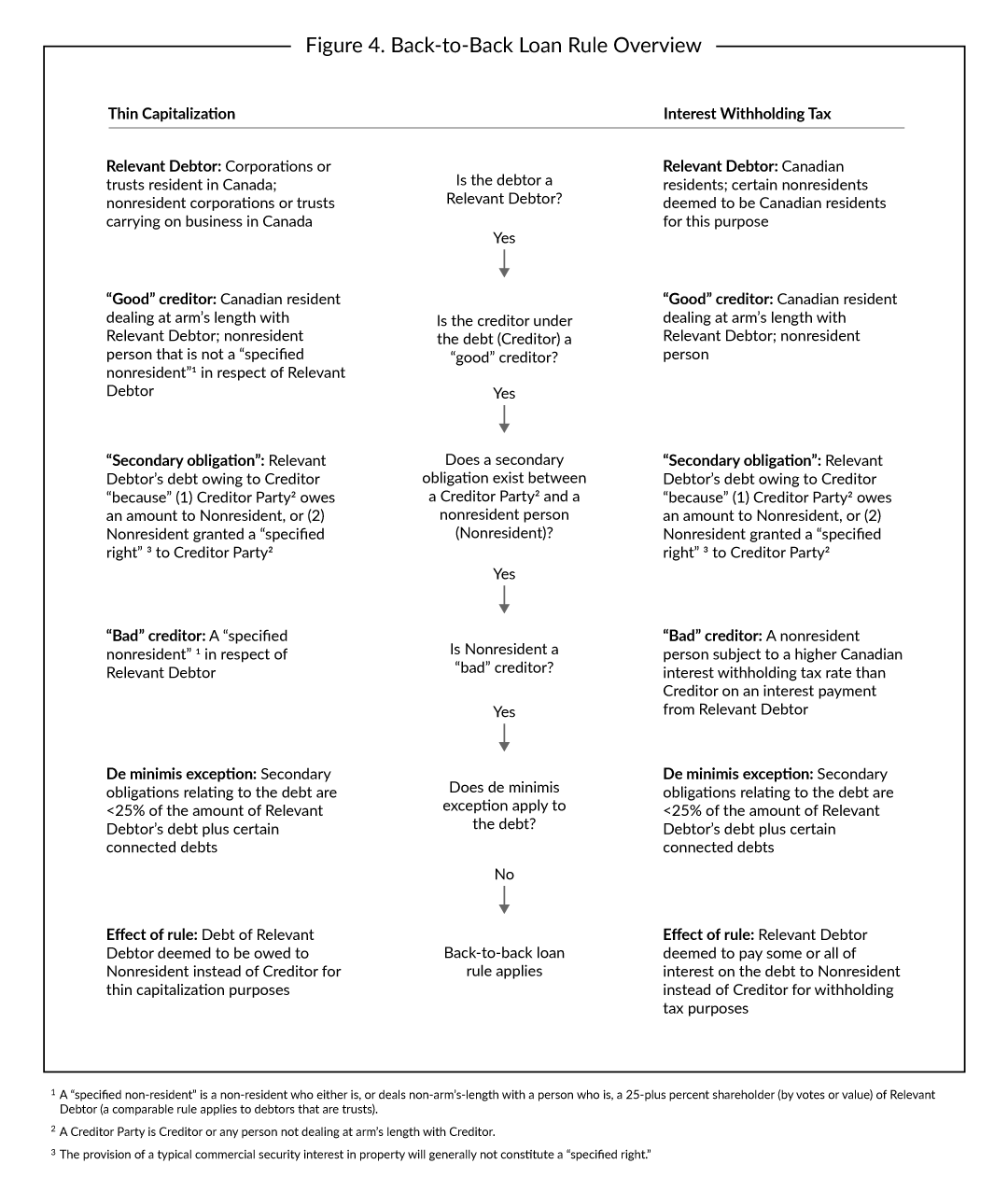

Canadian Subsidiaries Business Tax Canada

1099 Oid Patrick Devine In 2022 Devine Federal Income Tax Province

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

1099 Oid Patrick Devine In 2022 Devine Federal Income Tax Province

0 Response to "Withholding Tax Public Ruling"

Post a Comment